Credit Card Fraud Lawyer - Get Legal Help Now | Ervin Kibria Law

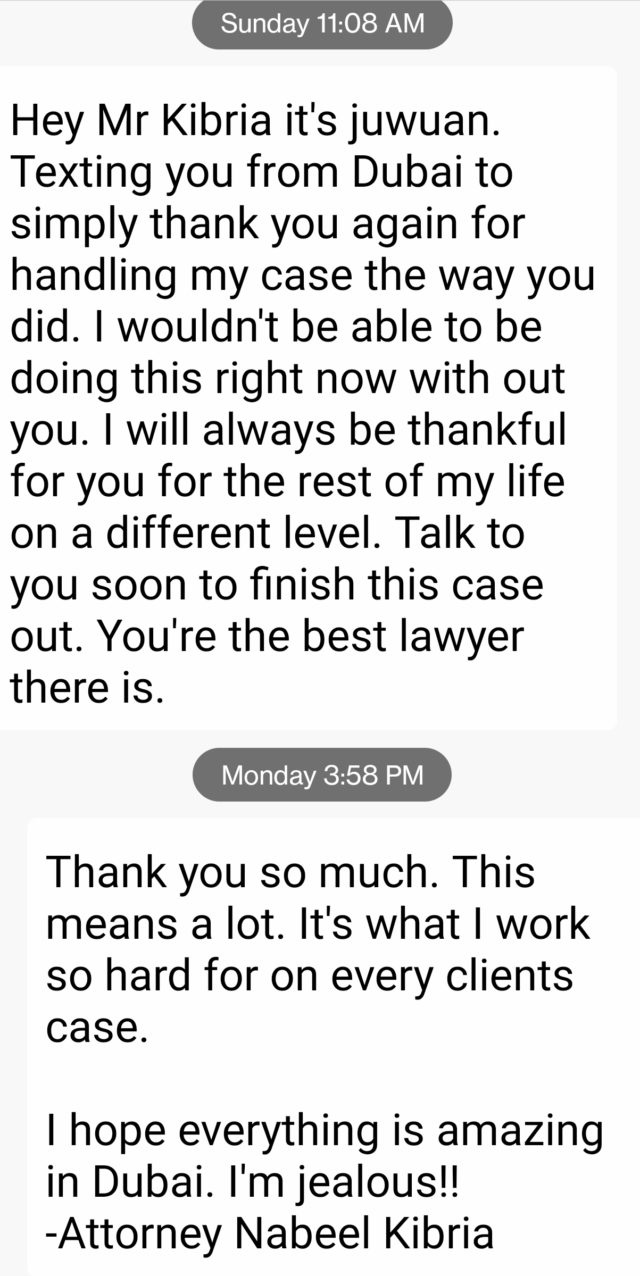

Awards and Accolades

Logo Carousels

CALL 24/7 OR FILL OUT THE FORM BELOW TO DISCUSS YOUR CASE

Featured In

Contact Ervin Kibria Today:

Protecting Your Rights and Future

Protecting Your Rights and Future

With the rise of electronic payment options, credit card fraud has become a growing concern in the District of Columbia. Unfortunately, while some individuals are victims of this crime, others are falsely accused. If credit card fraud charges have been brought against you in DC, seeking the assistance of a credit card fraud lawyer can have a significant impact on how your case turns out.

Defining Credit Card Fraud in DC

Credit card fraud involves the unauthorized use of someone else’s credit card information to make purchases or remove funds. This can be done with the physical card or the numbers associated with the account. Even if the card has been canceled or altered, using it without permission constitutes credit card fraud. False representation as the true account holder is also a form of credit card fraud.

What is Skimming?

Skimming is a method used to illegally obtain credit card information. This can be as simple as photocopying receipts at stores or restaurants or as sophisticated as using devices that scan and store credit card data from magnetic strips. Skimming typically occurs at places where credit cards are used for purchases, such as gas stations, stores, and restaurants. When numerous individuals’ credit card information is defrauded, credit card fraud charges can become severe very quickly.

Misconceptions About Credit Card Fraud

Some people may think that credit card fraud is not a serious crime since it does not involve violence or force. However, credit card fraud is a felony charge with severe consequences, particularly if it involves a vast conspiracy to obtain and use credit card information. As a result, law enforcement takes credit card fraud very seriously and spends a great deal of time building a case against suspects.

Role of a DC Credit Card Fraud Lawyer

Contacting a DC credit card fraud attorney immediately is crucial if you are charged with credit card fraud. Being convicted of credit card fraud can lead to criminal penalties, difficulties finding or keeping a job, and obstacles to obtaining credit or property. A credit card fraud lawyer can help determine which witnesses to locate and obtain statements from, what evidence to present, how to challenge the government’s evidence, and what legal arguments to make. They can also explain the benefits of negotiating a plea agreement or going to trial and exploring all possible defenses to build the best strategy for your defense.

Under the DC Code, the maximum penalty for credit card fraud is a fine of up to $25,000 and a prison term of up to 10 years. If the value obtained or sought is $250 or more, the charge is a felony. If the value is less than $250, an individual could be charged with a misdemeanor and face a maximum penalty of 180 days in jail and/or a $1,000 fine.

Protecting Your Rights and Future

Protecting Your Rights and Future